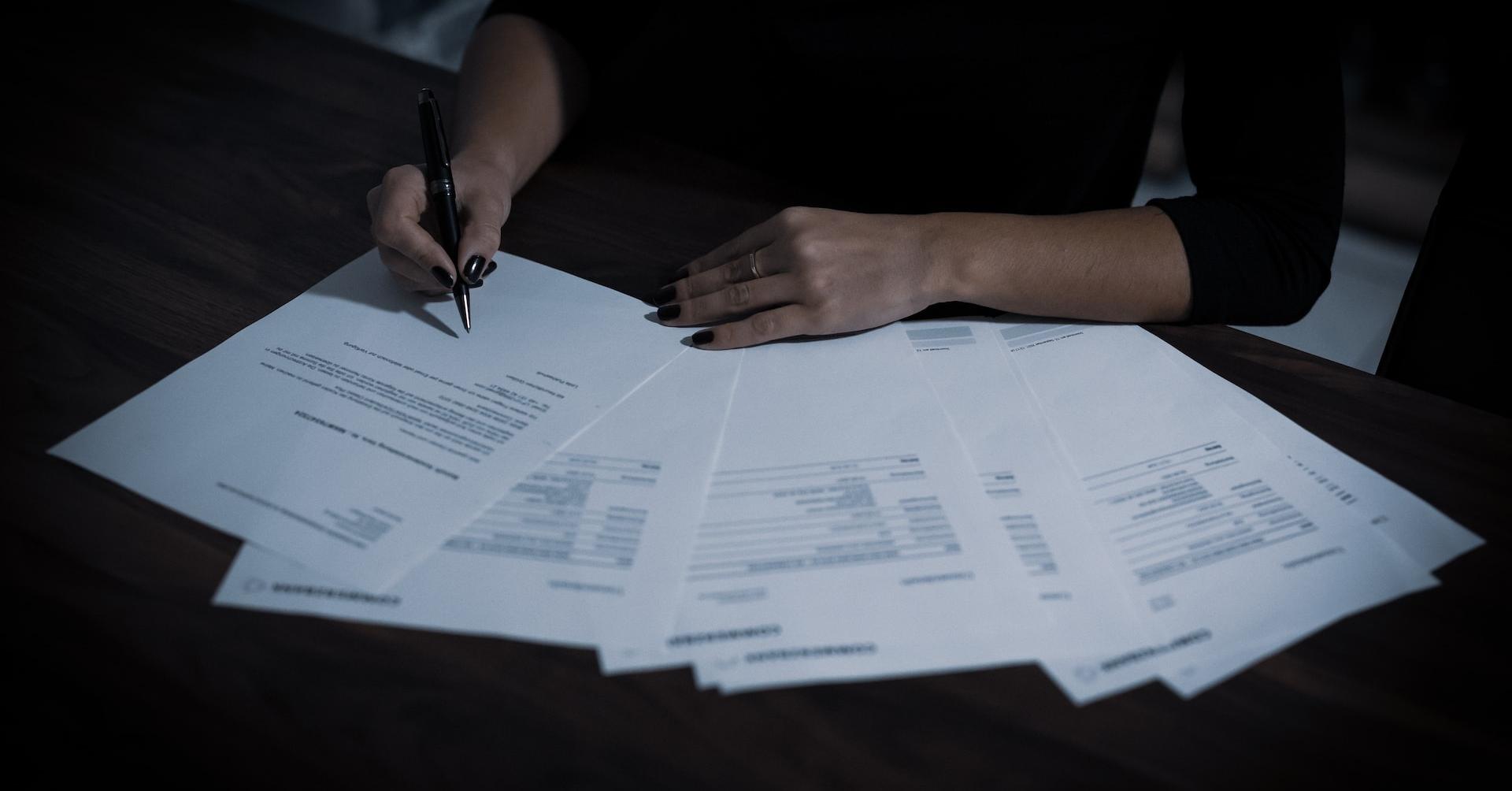

What Is LOI?

Are you curious to know what is loi? You have come to the right place as I am going to tell you everything about loi in a very simple explanation. Without further discussion let’s begin to know what is loi? In the realm of business and real estate transactions, the term “LOI” holds significant importance. Let’s delve … Read more